| Rating: 3.8 | Downloads: 10,000,000+ |

| Category: Shopping | Offer by: Afterpay |

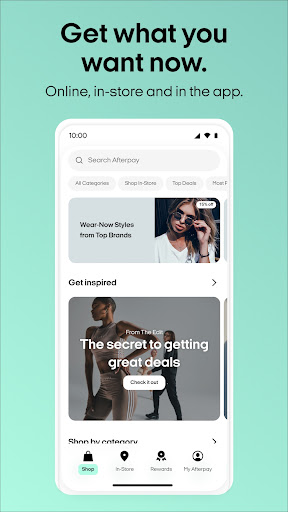

Afterpay App has revolutionized the way we shop by offering a convenient and flexible payment solution. With its innovative “buy now, pay later” model, Afterpay allows users to make purchases and pay for them in installments, without the need for traditional credit checks or interest fees. This app has gained significant popularity among consumers, providing them with greater financial flexibility and empowering them to make purchases without immediate full payment.

Features & Benefits

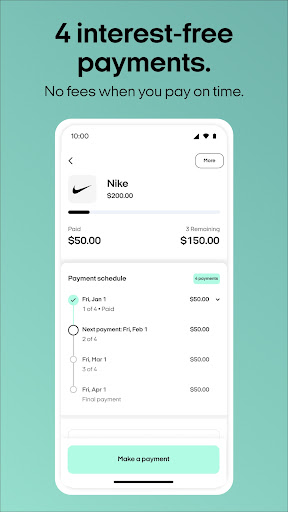

- Flexible Payment Options:Afterpay enables users to split their purchases into four equal installments, paid every two weeks. This feature allows shoppers to manage their budgets more effectively by spreading out the cost of their purchases over time.

- Seamless Integration:Afterpay seamlessly integrates into the checkout process of participating online and in-store retailers. Users can select Afterpay as their payment option, and the app automatically splits the total amount into manageable payments, making the purchasing process quick and hassle-free.

- No Interest or Hidden Fees:One of the standout benefits of Afterpay is that it charges no interest or hidden fees to its users. As long as payments are made on time, customers can enjoy the convenience of the app without incurring additional costs.

- Instant Approval:Afterpay offers instant approval for users, making it easy to set up an account and start shopping right away. Unlike traditional credit applications, Afterpay does not require complex paperwork or credit checks, providing a more accessible and inclusive payment solution.

- Improved Budgeting and Financial Control:Afterpay helps users manage their finances more effectively by breaking down their purchases into smaller, manageable payments. This feature allows shoppers to stay within their budgets while still being able to buy the products they desire.

Pros

- Convenient Payment Structure: Afterpay’s “buy now, pay later” model offers users the flexibility to make purchases and pay in installments, without the burden of upfront payments. This makes shopping more accessible and affordable.

- Instant Approval and Setup: The app’s seamless onboarding process ensures that users can quickly create an account and start using Afterpay immediately. The instant approval feature adds to the convenience and speed of the app.

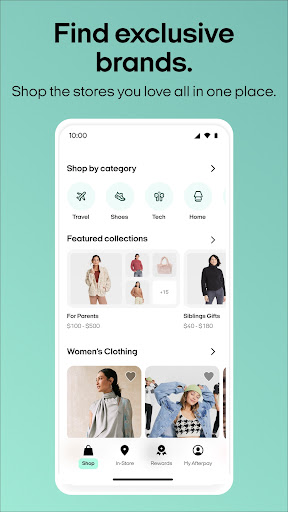

- Large Merchant Network: Afterpay has partnered with a vast network of online and physical retailers, providing users with a wide range of options across various industries. The app’s extensive merchant acceptance makes it a versatile payment solution.

- Budgeting and Financial Control: Afterpay’s budgeting tools enable users to manage their finances more effectively. The app’s features, such as payment reminders and spending limits, empower users to stay within their means and make responsible purchasing decisions.

- Streamlined Shopping Experience: Afterpay integrates seamlessly with online stores, allowing users to enjoy a smooth and hassle-free shopping experience. The app’s ability to track purchases, manage orders, and receive personalized offers enhances the overall shopping journey.

Cons

- Potential for Overspending: While Afterpay promotes responsible spending, the convenience of deferred payments may tempt users to overspend. Users should exercise caution and ensure that they can meet the installment obligations without compromising their financial well-being.

- Late Payment Fees: While Afterpay doesn’t charge interest fees, it does impose late payment fees for missed installments. Users should be mindful of payment due dates to avoid incurring additional charges.

- Limited Payment Flexibility: Afterpay requires users to make payments every two weeks in four equal installments. This structure may not suit everyone’s financial situation or budgeting preferences. Users should consider their payment preferences before using the app.

- Credit Checks for Some Users: In certain cases, Afterpay may conduct a credit check when users sign up for the service. While this is not always the case, users should be aware that their credit history may be evaluated during the registration process.

- Dependency on Partnered Retailers: Afterpay’s availability is contingent on the retailers it has partnered with. Some stores may not offer Afterpay as a payment option, limiting users’ ability to utilize the app for certain purchases.

Apps Like Afterpay

Quadpay:?Quadpay offers a “split it” payment option, allowing users to divide their purchases into four interest-free payments. The app is widely accepted at a range of retailers and offers a simple and transparent payment experience.

Klarna:?Klarna is a popular “buy now, pay later” app that allows users to split their purchases into installments and offers various payment options, including interest-free financing and flexible payments.

Sezzle:?Sezzle is a payment platform that enables users tosplit their purchases into four equal installments, with no interest or fees. It integrates seamlessly with online retailers and provides instant approval for users.

Screenshots

|

|

|

|

Conclusion

Afterpay App has transformed the way consumers approach shopping, offering flexible payment options and empowering them to make purchases without immediate full payment. With seamless integration, no interest or hidden fees, instant approval, and improved budgeting capabilities, Afterpay has become a popular choice for budget-conscious shoppers. While late fees and limited availability at certain retailers are potential drawbacks, the overall convenience and financial control offered by Afterpay make it a valuable tool for managing expenses and enjoying a seamless shopping experience.