[wptb id=185677]

About Chime – Mobile Banking App

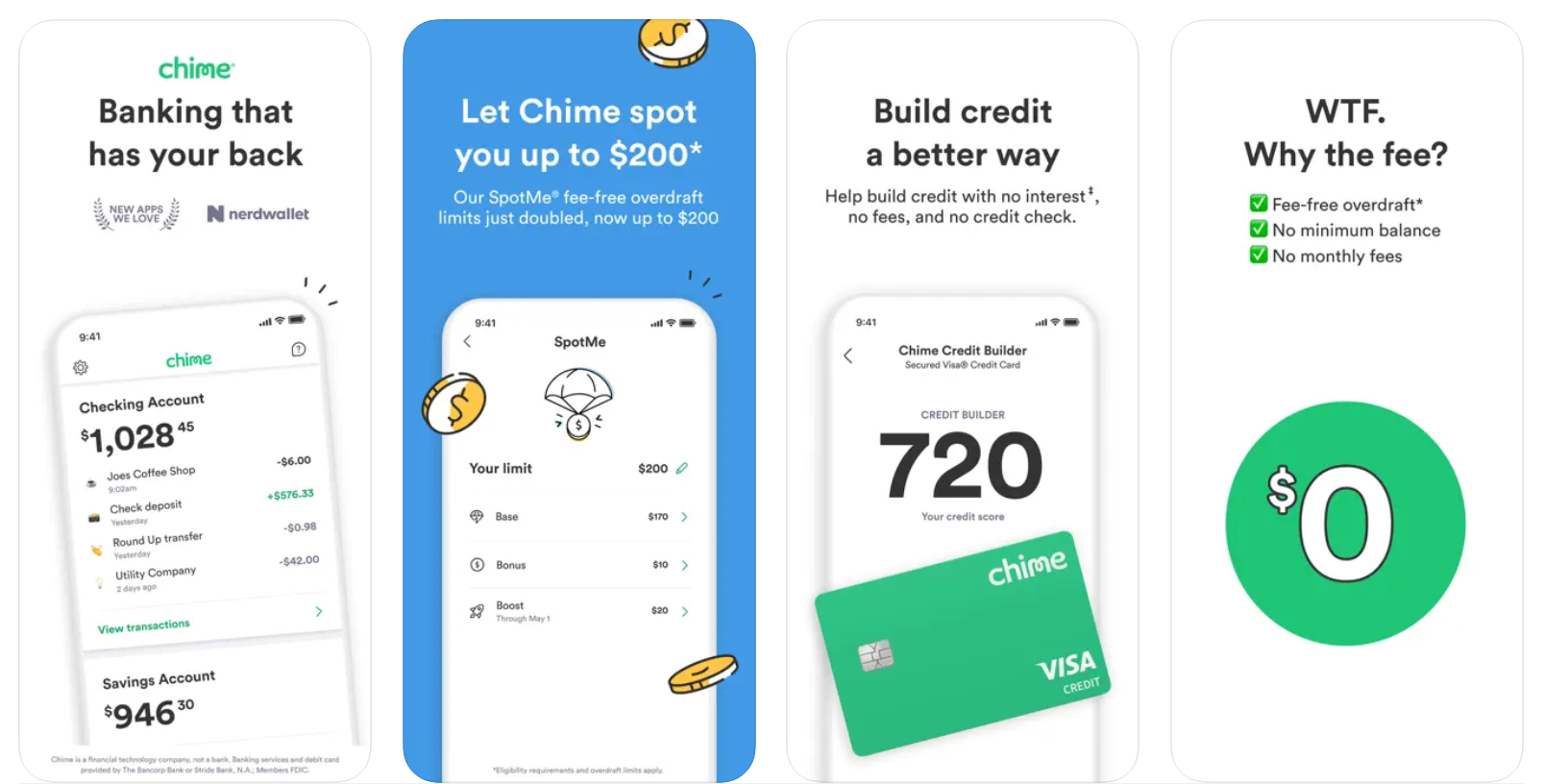

If you want to take charge of your financial situation, download the Chime app on your mobile device. You won’t have to worry about losing your money thanks to safeguards, may make use of overdrafts of up to $200* for free, and won’t have to pay any monthly fees to have your income deposited directly into the account.

Chime is not a conventional financial institution but rather a provider of financial technology. All deposits are insured to at least $250,000 by the Federal Deposit Insurance Corporation and may be made at either The Bancorp Bank or Stride Bank, National Association.

Features

Trustworthy

Stay on top of your money with real-time alerts for all of your transactions and daily balance checks. Turn on two-factor authentication, and you can freeze your card with a single mouse click.

Large Quantity

After having a low account balance, the last thing you need is an overdraft fee. Those who are Chime members and qualify can get up to $200 in overdraft protection for free, which can be used for everything from purchases to cash withdrawals from an ATM.

Eliminate Your Regular Financial Obligations Forever

This is a free service, and you should not be charged for it. Chime doesn’t charge you any sort of fee every month, no matter how much money you have in your account. About 60,000 free ATMs can be found at various retailers like Walgreens, 7-Eleven, CVS, and others.

Modified Methodology

By making on-time payments to retailers like gas stations and grocery stores, you can raise your FICO score by as much as 30 points with Credit Builder. No credit check, no interest, and no annual fee.

Make A Payment To Someone Without Having To Pay Any Fees Associated With The Monetary Transfer

Transfer money to loved ones as soon as you can send a text message and without incurring any costs.

Conclusion

Apps Like Chime – Mobile Banking

Cash App

You can send money to other people, including your friends and coworkers, using the Cash App, which is a cash utility that allows you to send money to other people. 2013 was the year that Square first exposed it to the public. As long as you have a Cash App account, you can send or receive money using any method that you have access to, including credit cards, debit cards, or any other alternative.

Mobile Banking Tips Money

The Wells Fargo banking app makes use of the features that are already present on your device in order to offer you with prompt access to your accounts. You have the ability to make deposits, pay bills, and conduct a variety of other things. The mobile application provided by Wells Fargo is accessible at no cost, is secure, and can be downloaded on any platform. If you have a Wells Fargo online banking app installed on your mobile device, you will be able to save time. It provides a wide variety of benefits, all of which work toward making your life simpler.

American Bank Mobile Banking

By utilizing the American Bank Mobile Banking App on their mobile devices, our customers have access to banking services that are both simple and secure.

If you are not currently a user of Bank OnLine, you will need to register on the American Bank website. If you already use Bank Online, you can immediately begin using Mobile Banking by installing the app and logging in with your existing credentials.

[wptb id=185678]