|

|

| Rating: 4.2 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: PayPal, Inc. |

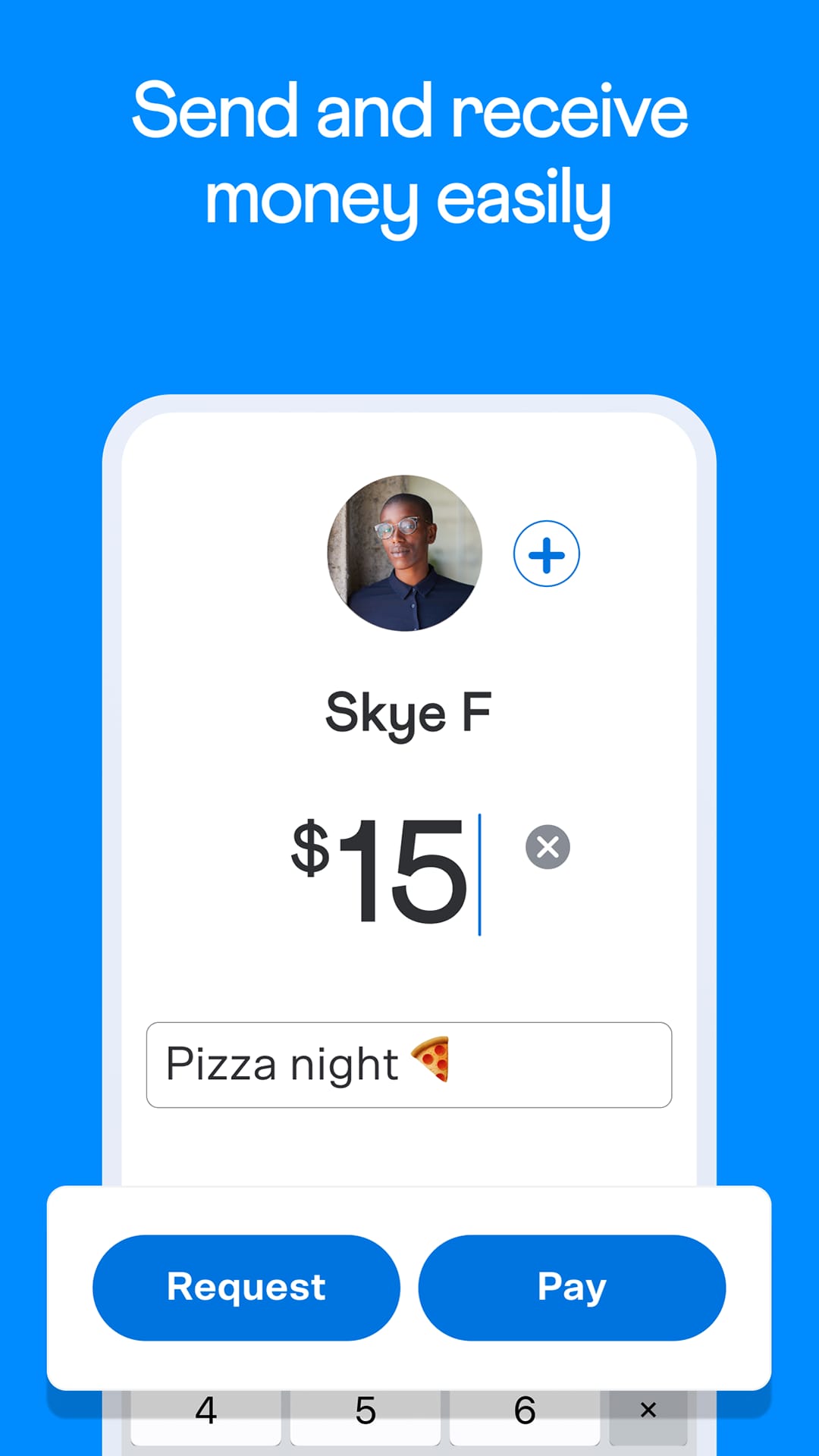

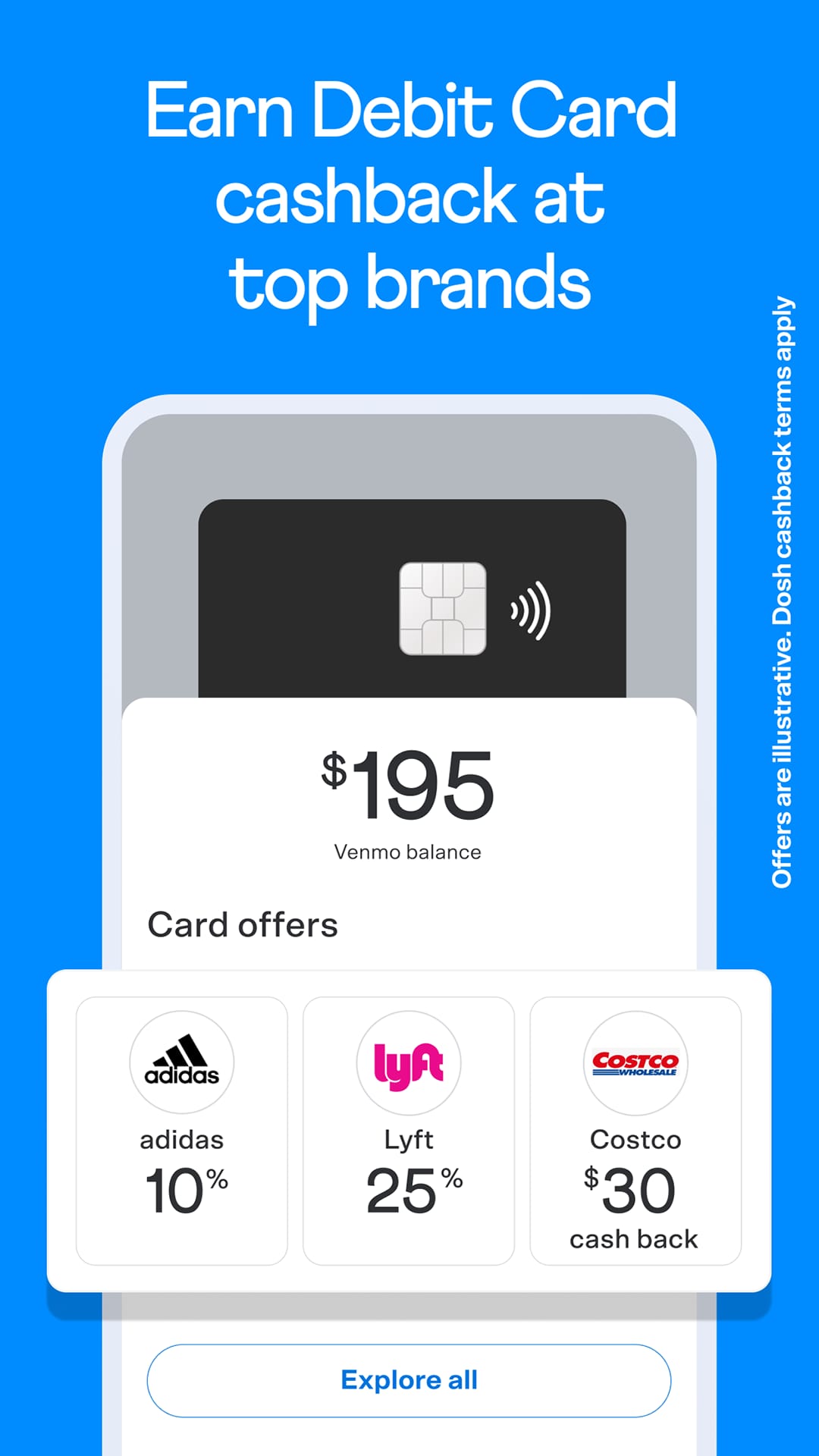

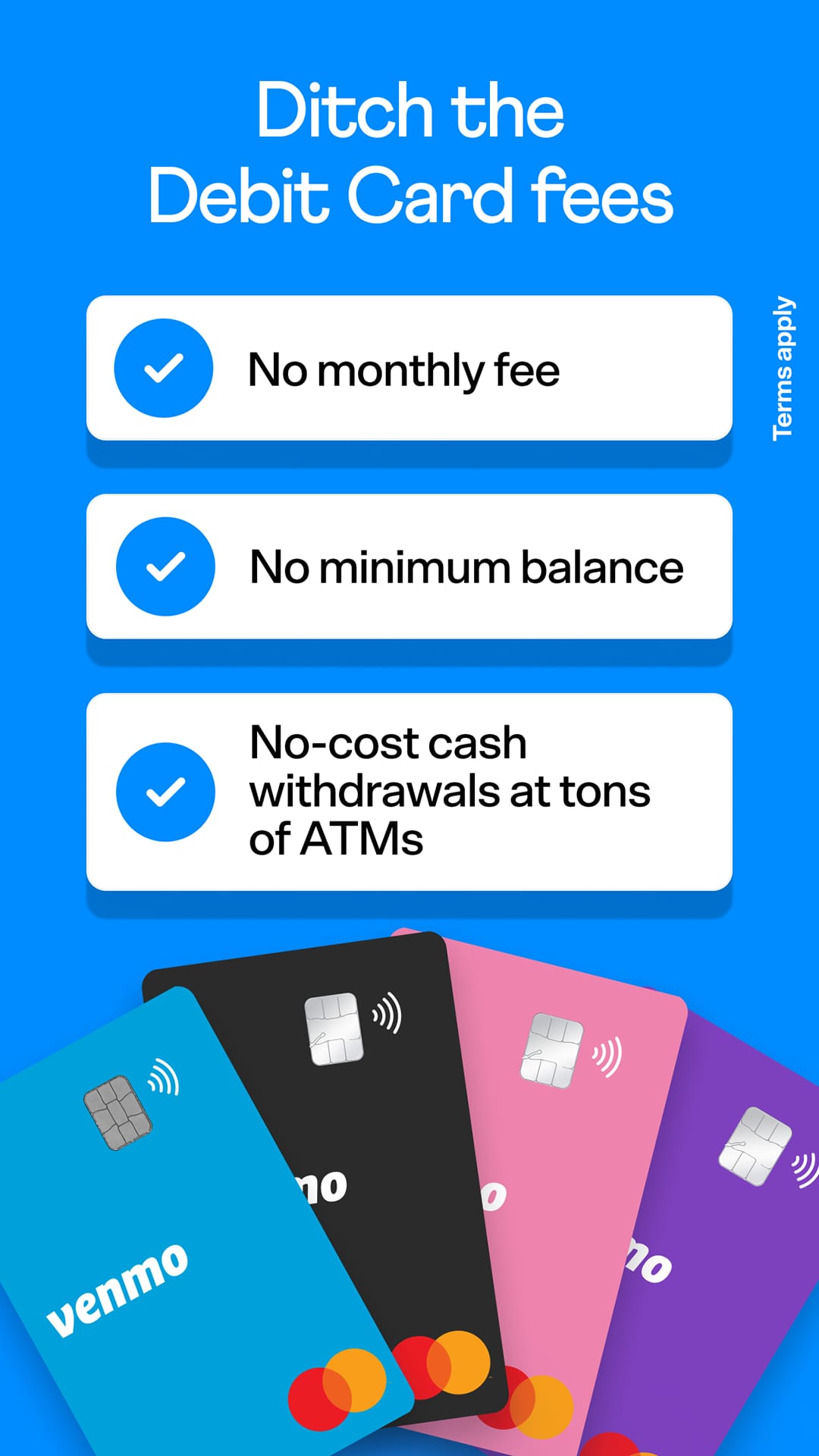

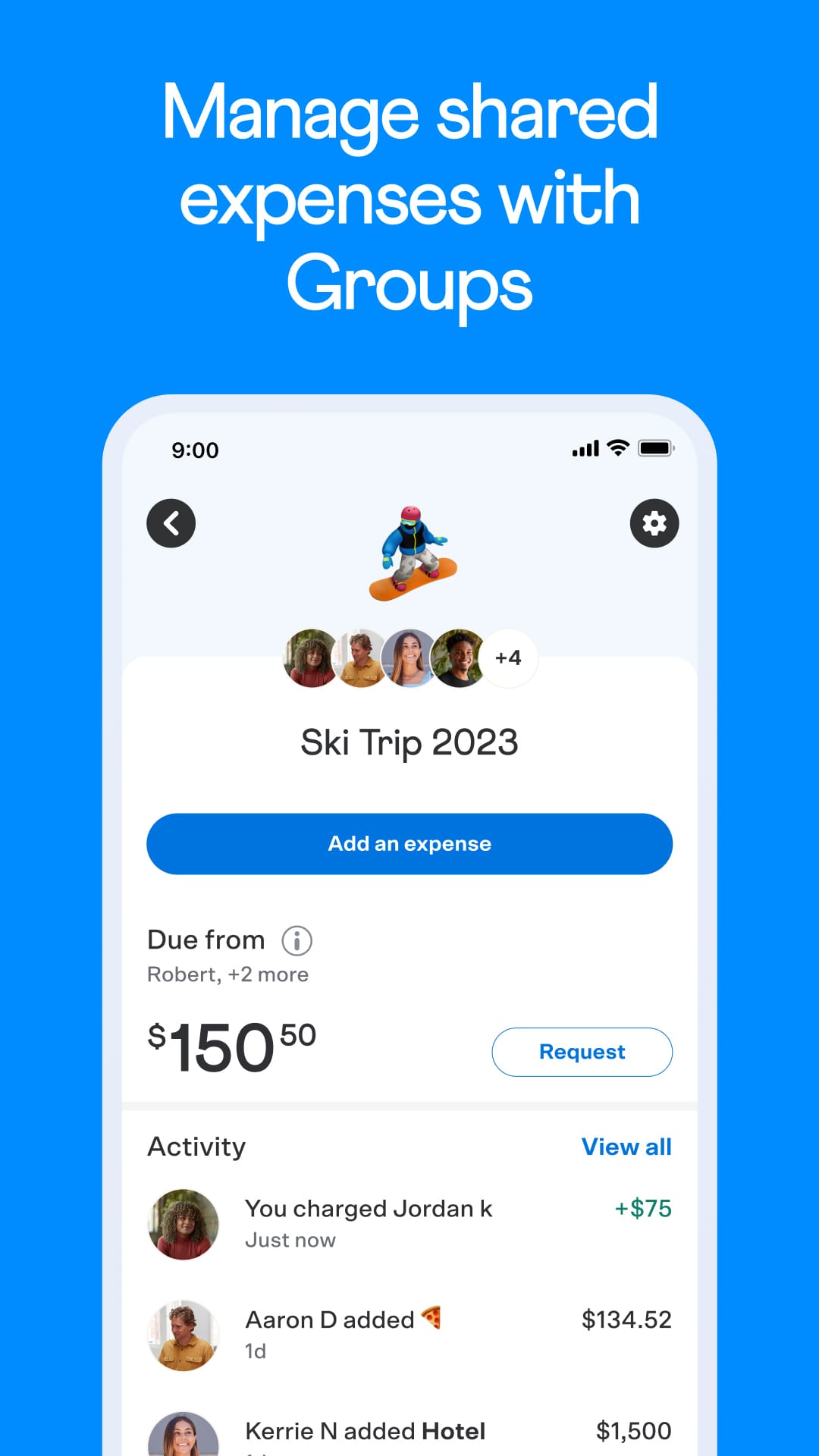

Venmo is a popular app that allows users to send and receive money quickly and securely. With over 83 million users, Venmo offers a convenient way to pay for a variety of expenses, from rent to gifts. Users can also add notes to their payments, allowing them to share and connect with friends. Additionally, Venmo now allows users to split a payment request among multiple friends, customizing the amount each person owes.In addition to its payment features, Venmo offers other financial services. Users can apply for a Venmo debit card, which offers automatic cashback when used at select merchants. There is no monthly fee or minimum balance required. Venmo also offers a credit card that provides cashback rewards on eligible purchases. Users can earn 3% cash back on their top spend category, 2% on the next, and 1% on the rest.Venmo also allows users to buy, hold, and sell cryptocurrency directly within the app. Users can start with as little as $1 and access in-app resources to learn more about cryptocurrency. However, it’s important to note that cryptocurrency is volatile and can fluctuate in value quickly, so users should proceed at their own comfort level.Furthermore, Venmo offers features for businesses. Users can create a business profile for their side gig or small business, all under the same Venmo account. Venmo also provides a touch-free payment option in stores through a QR code, allowing users to scan, pay, and go. Additionally, Venmo can be used for online purchases and in various apps, such as Uber Eats, StockX, Grubhub, and Zola.Overall, Venmo provides a range of convenient and secure financial services, including money transfers, cashback rewards, cryptocurrency trading, and business profiles. Users can manage their money easily with features like instant transfers and direct deposit. However, it’s important to review the terms and conditions for each service and consider seeking advice from financial or tax advisors when dealing with cryptocurrency.

Features & Benefits

- Easy Fund Transfers: Venmo enables users to transfer funds quickly and easily to others. Whether it’s sending money to a friend, paying back a loan, or receiving payments, Venmo simplifies the process with just a few taps. Users can link their bank accounts, debit cards, or credit cards to Venmo for seamless fund transfers.

- Splitting Expenses: Venmo makes it effortless to split expenses among friends or groups. Users can create a payment request and divide the cost of meals, utilities, or shared expenses. Venmo keeps track of who paid what and sends reminders to participants, ensuring smooth coordination and settling of bills.

- Social Interactions: Venmo incorporates social elements that add a fun and interactive touch to financial transactions. Users can like and comment on payments, adding emojis and personalized messages. This feature creates a social network-like environment, making payments more engaging and enjoyable.

- Venmo Card: Venmo offers a physical Venmo debit card that allows users to make purchases using their Venmo balance. The card can be used wherever Mastercard is accepted, providing users with a convenient and secure payment option, both online and in physical stores.

- Security and Privacy: Venmo prioritizes the security and privacy of its users. The app utilizes encryption and multi-factor authentication to protect financial information. Users also have control over their privacy settings, including the ability to choose who can see their payment activity.

Pros

- Easy and convenient fund transfers among friends and family

- Simplified process for splitting expenses and settling bills

- Social interactions and engagement through likes and comments

- Venmo debit card for convenient purchases with Venmo balance

- Strong security measures and user privacy controls

Cons

- Limited international functionality, primarily focused on the United States

- Transaction fees for certain types of payments, such as credit card transactions

- Public nature of payment activity, which may be a concern for those seeking more privacy

- Limited customer support options, primarily relying on self-service resources

- Dependency on internet connectivity for app functionality

Apps Like Venmo

PayPal: PayPal, the parent company of Venmo, offers a similar platform for sending and receiving money. With a wide user base, PayPal allows for seamless transactions, international payments, and integration with various online platforms.

Cash App: Cash App, developed by Square, provides a peerto-peer payment service that allows users to send and receive money quickly. It also offers features like a Cash Card for making purchases and investing in stocks.

Zelle: Zelle is a digital payment network that enables users to send money directly to bank accounts in the United States. It is often integrated into banking apps, making it convenient for users to transfer funds.

Screenshots

|

|

|

|

Conclusion

Venmo has transformed the way we handle financial transactions among friends, family, and businesses. With its easy fund transfers, expense splitting capabilities, social interactions, Venmo debit card, and robust security measures, the app offers a convenient and enjoyable platform for managing finances. While it has certain limitations, such as its focus on the United States and transaction fees, Venmo remains a popular choice for individuals seeking a seamless and interactive payment solution.