|

|

| Rating: 4.5 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Revolut Ltd |

The Revolut App is a revolutionary mobile banking app that has disrupted the traditional banking industry. With over 15 million customers worldwide, Revolut provides a range of innovative financial services and features that empower users to take control of their finances. Whether it’s managing money, making international transfers, or budgeting effectively, the Revolut App offers a comprehensive suite of tools in a user-friendly and intuitive interface.

Gone are the days of dealing with complicated paperwork, long wait times, and hidden fees. The Revolut App is designed to simplify banking and provide users with a seamless and convenient experience. With its advanced technology and smart features, Revolut is reshaping the way people manage their money, offering flexibility, transparency, and security all in one place.

Features & Benefits

- Global Money Transfers: One of the standout features of the Revolut App is its ability to facilitate fast and low-cost international money transfers. Users can send money to over 30 countries with no hidden fees and at competitive exchange rates. This feature is particularly beneficial for travelers, expats, and individuals conducting business internationally.

- Multi-Currency Accounts: Revolut allows users to hold and exchange multiple currencies within a single app. This feature eliminates the need for separate bank accounts for different currencies and makes it easy to manage finances across borders. Users can exchange currencies at interbank rates, saving money on foreign exchange fees.

- Budgeting and Analytics: The app offers powerful budgeting and analytics tools that help users track their spending, set financial goals, and gain insights into their financial habits. With features like spending categorization, instant spending notifications, and monthly spending breakdowns, Revolut empowers users to make informed financial decisions and take control of their budgets.

- Cryptocurrency Support: Revolut was one of the first banking apps to embrace cryptocurrencies. Users can buy, sell, and hold popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, directly within the app. This feature provides a convenient and secure platform for individuals interested in venturing into the world of digital currencies.

- Additional Services: In addition to its core banking features, Revolut offers a range of additional services, including travel insurance, mobile phone insurance, and access to premium features like airport lounge access and concierge services. These services enhance the overall value proposition of the app and make it a comprehensive financial management tool.

Pros

- Convenience and Accessibility: The Revolut App offers users the flexibility to manage their finances anytime, anywhere. With its mobile-first approach, users can access their accounts, make transactions, and monitor their finances on the go.

- Competitive Exchange Rates: Revolut’s interbank exchange rates for currency conversions are highly competitive, saving users money on foreign exchange fees compared to traditional banks.

- Advanced Security Features: The app provides robust security measures, including biometric authentication, transaction notifications, and the ability to freeze and unfreeze cards. These features ensure that users’ financial information and transactions are protected.

- Simplified International Payments: Sending money abroad is quick and straightforward with Revolut. Users can avoid the complexities and high fees associated with traditional banks, making it ideal for global travelers or individuals with international financial obligations.

Cons

- Customer Support: Some users have reported challenges with customer support, citing delays in response times and difficulty reaching a resolution for certain issues. However, Revolut has been actively working to improve its customer support services.

- Limited Accessibility for Non-App Users: While the app provides a seamless experience for smartphone users, individuals without smartphones or reliable internet access may face limitations in accessing and managing their accounts.

- Premium Features at a Cost: While the basic features of the Revolut App are free to use, certain premium features and services require a paid subscription.

Apps Like Revolut

- N26: N26 is a mobile banking app that offers similar features to Revolut. It provides multi-currency accounts, budgeting tools, and seamless international money transfers. N26 is known for its sleek design and user-friendly interface, making it a popular choice among digital-savvy individuals.

- TransferWise: TransferWise focuses on international money transfers and offers competitive exchange rates. Users can send money abroad at low fees and benefit from transparent pricing. While TransferWise doesn’t provide the same breadth of features as Revolut, it excels in its specialization of international remittances.

- Monzo: Monzo is a digital banking app that aims to simplify money management. It offers features such as budgeting tools, real-time spending notifications, and fee-free spending abroad. Monzo has gained popularity for its user-friendly interface and community-driven approach, providing a seamless banking experience for its users.

These three apps, like Revolut, are at the forefront of the digital banking revolution. They offer innovative features, convenient services, and user-focused experiences that challenge traditional banking models. Whether it’s managing money, making international transfers, or gaining insights into personal finances, these apps provide alternatives to traditional banks, empowering individuals to take control of their financial lives.

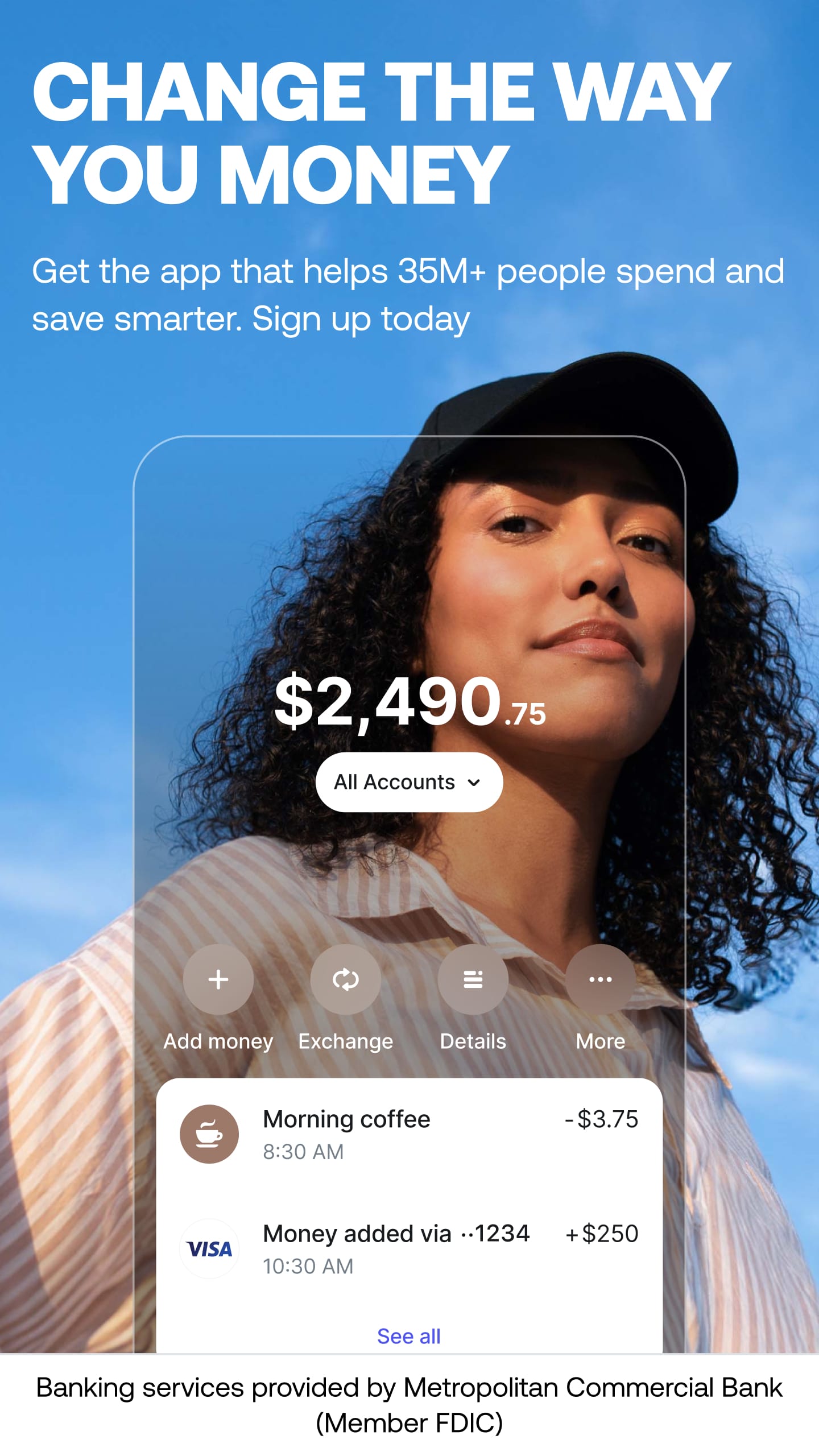

Screenshots

|

|

|

|

Conclusion

The Revolut App has reshaped the banking landscape by providing users with a powerful and convenient tool to manage their finances. With its global money transfer capabilities, multi-currency accounts, budgeting features, cryptocurrency support, and additional services, Revolut offers a comprehensive suite of financial management tools. While there are some limitationsto consider, such as customer support responsiveness and limited accessibility for non-app users, the overall benefits and convenience that Revolut offers outweigh these drawbacks.

For individuals seeking a modern and user-friendly banking experience, the Revolut App is a compelling choice. It empowers users to take control of their finances, save money on international transactions, and gain valuable insights into their spending habits. With its advanced security features and competitive exchange rates, Revolut provides a secure and cost-effective solution for managing money in an increasingly globalized world.